Introduction

Managing finances on a limited income can be challenging, but investing wisely can help secure your future. If you’re a low-salaried person looking for the best investment options, you don’t need a hefty paycheck to start. With the right approach, even small investments can grow into significant savings over time. In this guide(investment options for low income persons- the ultimate guide to grow your wealth 2025), we’ll explore affordable and low-risk investment options tailored for individuals with limited earnings.

Why Should Low-Salaried Individuals Invest?

Many low-income earners believe that investing is only for the wealthy, but that’s a misconception. Even with a modest income, investing can help you:

- Beat inflation

- Build wealth over time

- Secure financial independence

- Meet long-term goals such as homeownership, education, and retirement

The key is to start small and stay consistent.

Best Investment Options for Low-Salaried Individuals

1. Recurring Deposits (RDs)

A Recurring Deposit1 is one of the safest investment options for low-income earners. It allows you to invest a fixed sum monthly, which earns interest over time.

Benefits:

- Guaranteed returns

- Low risk

- Fixed interest rate

- Ideal for short-term savings

How to Start:

- Open an RD account with a bank or post office

- Set up automatic monthly deductions

- Choose a tenure ranging from 6 months to 10 years

2. Public Provident Fund (PPF)

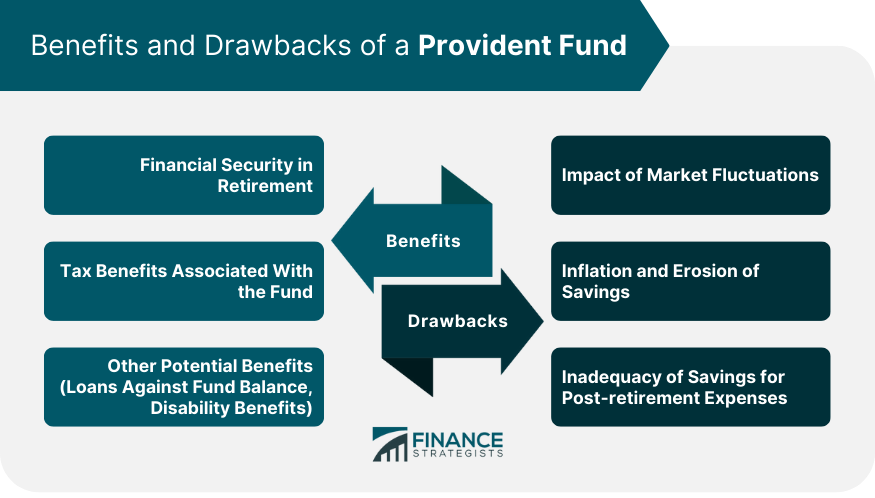

PPF2 is a government-backed long-term investment scheme that offers tax-free returns. It’s a great option for low-income earners looking for a secure retirement plan.

Benefits:

- Tax-free interest

- Long-term wealth accumulation

- Government security

How to Start:

- Open a PPF account in a bank or post office

- Invest a minimum of ₹500 annually (maximum ₹1.5 lakh)

- Lock-in period of 15 years (with partial withdrawal allowed after 6 years)

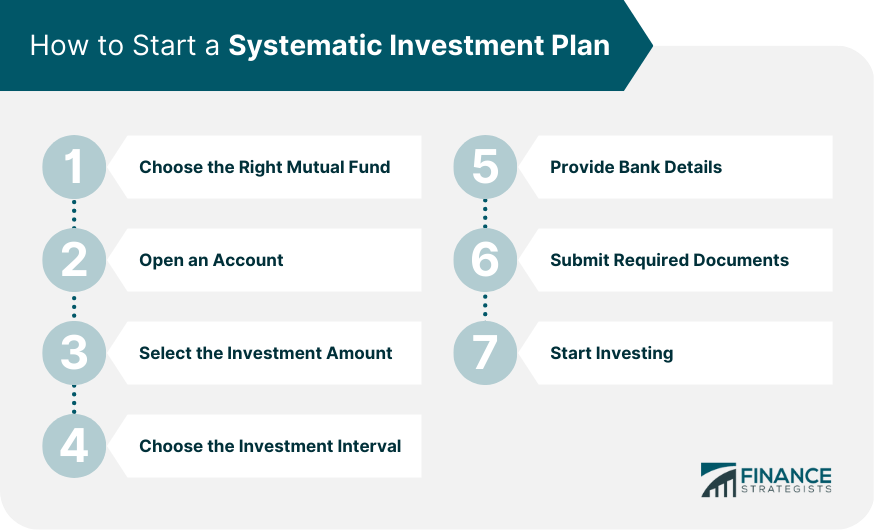

3. Mutual Funds (SIP Investment)

Systematic Investment Plans (SIPs)3 in mutual funds allow individuals to invest small amounts regularly while benefiting from market growth.

Benefits:

- Higher returns compared to traditional savings

- Professional fund management

- Rupee cost averaging reduces market risk

How to Start:

- Choose a mutual fund with a good track record

- Start with as little as ₹500 per month

- Invest consistently for long-term wealth creation

4. Gold Investments (Sovereign Gold Bonds & Digital Gold)

Gold4 is a trusted investment option . Low-salaried individuals can invest in Sovereign Gold Bonds (SGBs) or digital gold to avoid storage hassles.

Benefits:

- Hedge against inflation

- No need for physical storage

- Government-backed (SGBs)

How to Start:

- Buy SGBs through banks or post offices

- Invest in digital gold via online platforms

- Choose gold ETFs for better liquidity

5. Post Office Monthly Income Scheme (POMIS)

POMIS5 is a secure investment option that provides a fixed monthly income.

Benefits:

- Low risk

- Fixed interest rate

- Ideal for retirees and individuals seeking stable income

How to Start:

- Open an account in a post office

- Minimum investment of ₹1,500

- Tenure of 5 years

6. National Pension System (NPS)

NPS is a pension scheme aimed at ensuring financial security post-retirement.

Benefits:

- Tax benefits

- Market-linked returns

- Pension after retirement

How to Start:

- Open an NPS account with a bank

- Invest as low as ₹500 per month

- Withdraw a portion at retirement and receive a pension

7. Fixed Deposits (FDs)

Fixed Deposits are a secure way to grow savings over time with a fixed interest rate.

Benefits:

- Zero risk

- Fixed returns

- Flexible tenure options

How to Start:

- Choose a bank with a high FD interest rate

- Invest a lump sum or small monthly deposits

- Select tenure based on financial goals

8. Stock Market Investments (For Risk-Takers)6

If you’re comfortable with calculated risks, investing in stocks can generate high returns.

Benefits:

- High return potential

- Ownership in growing companies

- Liquidity

How to Start:

- Open a Demat account

- Research and invest in fundamentally strong stocks

- Start with small investments and diversify your portfolio

9. Real Estate (Micro-Investments in REITs)

Real Estate Investment Trusts (REITs) allow individuals to invest in real estate with small amounts.

Benefits:

- Passive income

- Diversification

- Lower investment compared to direct property purchase

How to Start:

- Invest in REITs via stock exchanges

- Research real estate mutual funds

Tips to Maximize Your Investments on a Low Salary

- Set a Budget: Allocate a fixed portion of your income for investments.

- Avoid Unnecessary Expenses: Cut down on discretionary spending.

- Automate Investments: Set up auto-debits for SIPs, RDs, and PPF.

- Start Small but Be Consistent: Even ₹500 per month can grow into a significant corpus over time.

- Diversify: Spread your investments across different options to minimize risk.

- Increase Investments Gradually: As your income grows, increase your investment contributions.

Conclusion

Investing is not limited to high earners. With discipline and the right approach, even low-salaried individuals can build wealth over time. The key is to start early, stay consistent, and choose the right investment vehicles that match your financial goals. Whether it’s a PPF, SIP, or digital gold, every investment counts toward a better financial future.

Start today, invest wisely, and secure a financially independent future!

Read more: How to Build a brand Not just a business

- A recurring deposit (RD) is a savings account where you make regular monthly payments to build up funds over time. You can earn interest on your deposits, which is usually compounded quarterly. At the end of the term, you receive the principal amount plus interest. ↩︎

- A Public Provident Fund (PPF) is a savings account that allows residents to save money for retirement. It’s a safe and popular long-term investment option. ↩︎

- A Systematic Investment Plan (SIP) is a way to invest in a mutual fund by regularly investing a fixed amount. SIPs are a disciplined way to save money and grow wealth over time. ↩︎

- A gold investment is the purchase of gold as a way to diversify risk and hedge against volatility. Gold is a popular investment because it has been a safe haven in many countries. ↩︎

- POMIS is a government-backed investment scheme offered by the Department of Posts ↩︎

- A stock market, equity market, or share market is where people buy and sell stocks ↩︎