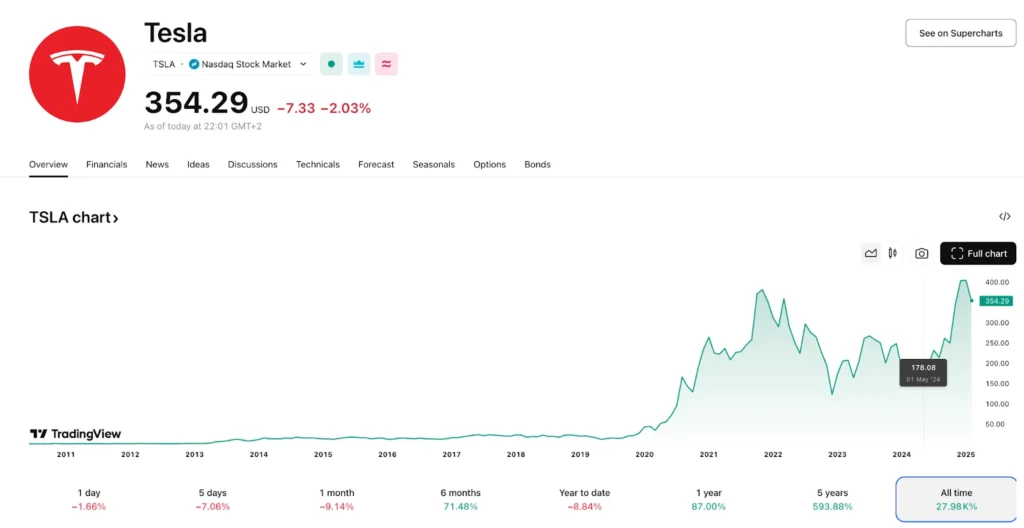

Due to declining sales, political unrest, and escalating competition, Tesla’s stock fell 45% in just three months. Is Musk able to guide Tesla’s future, or is it exaggerated? Tesla fell out of the air by 45% in barely 3 months, which really freaked out investors as this depreciation raised a question of its appraisal and further prospects of development. Nevertheless, discussions are still continuing over whether Tesla remains an object of higher valuation as part of the possibilities of long-term investment or an example of a company that’s overvalued, says the Reuters report. How Tesla Stock Crashes 45% In 3 Months

Why Are Tesla Shares Falling badly?

Since its peak of $1.5 trillion on approx. December 17, 2024, Tesla’s market value has experienced a significant decline today. How is responsible for this?? Elon Musk was significantly responsible for the spike in stock value at the time, as he provided financial backing for Donald Trump’s election triumph. But in the months that followed, Tesla had to deal with dwindling sales and earnings in addition to growing investor unease over Musk’s political activities. This move is not loved by Elon and co.

Reason is mentioned below

Tesla’s stock decline has been caused by a number of important factors:

1) Vehicle sales and profitability are declining.

2) Elon Musk’s political affiliations, especially his position as Trump’s advisor

3) Elon musk contribution and focus is shifting from Tesla

Even after this decline , still Tesla’s market value of about $845 billion is still much more than the combined worth of a number of conventional automakers due to efforts of Elon .

Growing Competition in the EV Market

Tesla’s stock could significantly fall from its current high still have good market value . The uncertainty about the EVs sector has made Tesla a leader in the competition. Cybertruck is the only model of Tesla since 2020 to disappoint. Musk had promised to get rid of the Model Y from the company line up by the end of 2020, but it was delayed until the end of 2021. Even now, Tesla lies in the 20th position as the bestselling car in the local market while Nio and Li Auto take the first 2 positions. As per the latest, Tesla’s stock was last selling at $387.09, and it went up 3.88% during the premarket trading.

Furthermore, the will of Tesla is not the only thing they are fighting against now, the company is running into Trump, the person Musk is a supporter of. He is advocating to cut off the existing EV subsidy programs that the company has utilized to bolster its cash inflow over the past years. Still, Musk argues that EV makers must be forced to spend more on their production lines than they used to if they want to see the prices of EVs fall.

However, unlike Toyota, China no longer relies on renewables but instead has been buying one-third of Toyota’s hybrids with battery-only power.

What’s Next for move for Tesla?

Tesla’s future is still uncertain due to growing competition, changing regulations, and investor concerns over leadership diversions. The crucial question still stands: Will Tesla’s developments in self-driving and artificial intelligence technologies revolutionize the auto industry as Musk hopes, or is the company’s valuation more hype than substance? Time will tell.